5- bitcoin overview

What 10,000 Bitcoin could buy you in 2010: two large pizzas

What 10,000 Bitcoin could buy you these days: a small island, a villa, and a yacht

Here we are, finally: ready to actually start talking about Bitcoin. We are done with fiat, I promise.

Over this long chapter, you’ll learn some mind-blowing facts about BTC: what it is, how it operates, who “controls” it, and how it was created. We’ll also expand on its best qualities and most defining features, after having previously hinted at them.

As you will soon learn, Bitcoin has many faces. Depending on its user, it can be several different things: from a mere “investment” to a literal lifesaver.

Let’s get into it.

🟠From zero to hero

What started as a “nerd experiment” in early 2009 — an attempt at innovating online payments, happened to become the best performing financial product in recorded history.

Not only that: it outright reshaped the decaying monetary system, and forever changed the future of money.

You heard that right: Bitcoin annihilated every other asset class on the market: no one came close to matching its spectacular ascent.

180,000,000%.

That’s, at the time of writing, Bitcoin’s value increase since its launch.

And it’s a big number: 180 million percent! I’ll give you a minute, so that you can fully appreciate just how impressive that is.

For context, gold, the dethroned king of money, and still regarded as the best store of value available, saw a 265% appreciation since 2009; while the S&P 500, the “safe investment benchmark”, rose roughly 900%.

“You gotta pump those numbers up. Those are rookie numbers in this racket!”.

Bitcoin is currently the 6th largest asset class on the market, with its 2.45 trillion dollar capitalization, and with no plans on slowing down.

The best part? We are still in the early days.

Don’t believe me? Ask ten random people “what is Bitcoin?”

Statistically, more than five of them will tell you they have no idea.

The rest will tell you Bitcoin is a scam, a gamble, or some sort of fraud.

Out of those ten, only one may actually come up with a somewhat accurate answer. Or maybe not.

Those who truly understand it are very rare to find, and that tells us we still have a long way to go.

Which is exciting: you have the possibility to enter the future financial elite, today, just by educating yourself, and making the conscious decision of leaving fiat behind; only to upgrade to “proper money”: Bitcoin, of course.

Isn’t it crazy? Only 2% of the world population is believed to hold some amount of it, in spite of its stellar, never-seen-before performance. Who wouldn’t want to purchase the best asset in history?!

This perfectly demonstrates what I told you in this guide’s introduction: people are afraid of change, too scared of letting go, and too lazy to embrace something completely new.

But you are not one of them.

Fiat can be printed into oblivion, while Bitcoin has a limited maximum supply of 21 million units.

🟠The soul of Bitcoin

We tried to define money. Now, let’s try doing the same with Bitcoin, in a few short paragraphs, while highlighting its most iconic qualities.

I will intentionally refrain from using too many strange words, and I am now assuming you have never, or almost, heard about Bitcoin before.

That means: no lengthy walkthroughs, no unnecessary details. We have time for those, you’ll see. In fact, the upcoming chapters will do just that.

For now, there is no need for you to be overwhelmed with a load of new information. Let’s keep it simple.

Bitcoin — or BTC: the two are interchangeable these days — is, first and foremost, a form of money and a currency.

That means Bitcoin can be used in the exchange of goods and services, and it can serve as a store of value.

Bitcoin is a digital-only payment system: it’s not physical.

Now, this opens up to a whole realm of dangers and inconveniences, such as counterfeiting, cheating, or copying. This money is essentially a piece of software, and adequate safety measures must be put in place.

Say hello to Bitcoin’s main component, a place called “the blockchain”— a publicly accessible ledger, similar to an old-fashioned ledger book, where every Bitcoin transaction is permanently and irreversibly recorded.

You heard that right: anytime you send Bitcoin to your friend, it will be forever imprinted into the system, on the blockchain, where anyone is able to “look around”, if you will.

That’s basically what that is: a very long list of transactions dating back from 2009 and updated with new transactions every 10 minutes.

The blockchain is like the sun in our solar system, and everything, in the Bitcoin ecosystem, revolves around it.

Another serious issue that may arise now is: how do I know that these transactions are genuine? Have they been faked? Who tells me that my Bitcoin is real and not a cheap imitation, just like fake notes?

Excellent question!

Bitcoin, as a whole, rewards hard work, transparency and, on the other hand, is incredibly strong and resilient — almost bulletproof — when it comes to fraud, manipulation, and corruption.

Keeping the system free from those nasty shenanigans is hard work.

“Maintaining” the blockchain and preserving its pristine attributes is only accessible to those who, via tremendous energy consumption in the form of computer power, are willing to partake in the process.

They are the miners: individuals that, through a complex process of advanced problem-solving, are in charge of publishing Bitcoin transactions on the blockchain. Every time they do that, the system rewards them with some newly minted Bitcoin.

Now, this may sound trivial or insignificant to you, but I invite you to reflect on its sheer importance.

On the surface, Bitcoin is easy.

I send you some, you receive it, and our transaction is forever stored on the blockchain.

Every single one of those 1.2 billion (and growing) transactions that are recorded there are 100% authentic. Yes, you are absolutely guaranteed that what you see on the blockchain has first gone through a serious process of validation.

As we just said, that’s partly thanks to the miners.

Partly — because there are other big players in the game, and those are called “the nodes”.

Nodes are like superheroes, and their job is so incredibly important it’s hard to put into words. They are the reason Bitcoin is known as a decentralized system.

We are getting to the heart of Bitcoin. This is indeed what made me fall in love with it, as a person that has always valued concepts such as liberty and independence.

Bitcoin is not a company and it’s not a consumer product. It doesn’t have a CEO, a manager, an owner, or a marketing team. Bitcoin has no employees. No single entity or authority has direct influence or ownership over it.

Bitcoin operates outside of the traditional financial system: it is not tied to any bank, government, or corporation; and it works independently of any third party.

We are talking about a widely distributed network that’s run and “managed” by volunteers, fundamentally. Yes, these are the nodes.

Computers, tens of thousands of them, controlled by Bitcoiners like you and me, that simply downloaded the Bitcoin software along with a copy of the blockchain.

Indeed — the software is free and it’s open source, meaning it’s not proprietary or private.

Each node around the world stores a precious copy of it.

We can think of each single node “one of the many protectors of Bitcoin”.

And yes: you can download the blockchain yourself, on your PC. At the time of writing, that’s roughly a 1TB file.

Nodes are guardians and safekeepers: they ensure Bitcoin remains in the hands of thousands of people rather than a single authority.

The other immensely important duty nodes have to carry out is to validate and authenticate every single transaction that takes place, before miners are allowed to post them on the blockchain.

This is crucial. Nodes are like the referees, and they make sure everyone plays fair. They keep a copy of the “rule book”: the Bitcoin software.

Each time a transaction is initiated, it gets “passed” to the nodes, which check it against the software’s mandates. If it complies, it gets a stamp of approval.

At the end of the day, that’s what Bitcoin is: a protocol — a set of rules participants agree upon, and one that’s not governed by a central authority.

Is Bitcoin anarchy? Well, sort of! It’s something like “organized chaos”.

That’s because Bitcoin, at its core, is indeed anarchic: the strong rejection to the idea of being ruled is one of the founding principles.

No one has the power to take, control, or manipulate your Bitcoin. Nobody can “tell you what to do” or prevent you from sending or receiving it.

Banks, anyone?

This idea of strong independence and self-reliance — “Permissionless”, is another one of those keywords which perfectly describes Bitcoin. When I wish to send you some SATs, I do not need anyone’s approval. I just send them. No other company, no person, or middleman is in the picture: it’s all in the code. You are able to transact anytime, anywhere. That’s what freedom feels like.

But hey, do not be mistaken. Bitcoin isn’t a “no man’s land”, a lawless space where anything goes; nope. Rules are plenty, and they must be followed. The network is secured and enforced by nodes and miners, who, among other things, cross-check each other in order to prevent any sort of cheating.

If fiat is more akin to a dictatorship, where one or a few people make decisions that affect millions, Bitcoin is more similar to a republic, as it belongs to the people; with some anarchy sprinkled in, because why not.

It is now clear this system does not operate in a specific area or region— Bitcoin is global, and it runs on the internet.

That’s all you need: an internet connection. No IDs, no documents, intermediaries or bank-like procedures.

Using Bitcoin is therefore fast, convenient, and easy. Transactions are usually finalized in just a few minutes, and the “machine” operates 24/7, 365 days a year. No matter how far you are sending your money: you can rest assured it will be received extremely quickly, only for an inconspicuous fee.

Security is another important concept.

Bitcoin is built on cryptography: a sophisticated technology that, with the use of cryptographic keys, ensures your transactions are conducted smoothly and safely. Unless a critical user mistake occurs, nothing can really go wrong. The same goes for ownership: if “stored” correctly, this is the only form of money — or asset — where true, 100% ownership is guaranteed.

Not only that — Bitcoin also protects your privacy, despite every transaction being public. This may sound counter-intuitive at first, but it’s easily explained. Your Bitcoin address, which you must use to send and receive money, is not, like bank accounts are, tied to your identity.

An address is a long string of letters and numbers, and it does not bear any of the user’s data.

Now, that does not mean Bitcoin is anonymous. Please be aware that your identity, as we will go on to explain, can indeed be guessed by authorities or blockchain nerds. You are not invisible: you are shrouded in fog, if you will.

A super-quick recap before we move on: Bitcoin is decentralized, it’s a global payment system that apparently cannot be hijacked or manipulated, and that works in a very efficient and fast manner. It’s also a world where, for the sake of transparency and integrity, transactions are recorded on a public ledger where the real identity of its users is not compromised. We also learned that transactions, before being published on the blockchain, are authenticated by the nodes, those computers that safeguard Bitcoin by storing a copy of both its software — the protocol — and the blockchain.

That’s, in an extremely simplified way, how Bitcoin works.

However, we still haven’t mentioned what’s arguably, at least for many, the most exciting bit!

This is what separates, more than anything, BTC and fiat money: its total supply.

After what you previously read, you are now aware that fiat can be endlessly produced, with all the awful consequences attached.

This, together with several other factors, causes inflation: public enemy no.1.

Now, I can see Bitcoin flexing its muscles as it’s hearing what I just said.

That’s because its biggest strength lies in its limited and “capped” total supply.

Yep — Bitcoin cannot be “printed” or “made” at will: it follows a precise schedule, which was carefully programmed by its creator, back in 2009.

21 million.

Engrave that number in your mind, because that’s your north star, as a Bitcoiner.

21 million Bitcoin: that’s how many coins will ever be produced in history.

We will go into detail, don’t worry. We don’t have time now: this is a massive topic.

Suffice to say that’s one of the main driving forces behind Bitcoin’s incredible run and price appreciation. Similarly to gold, whose total supply is finite, Bitcoin makes for an amazing “store of value”.

This makes it, in stark contrast to dollars, deflationary — as opposed to inflationary.

Fewer and fewer units enter the economy, as time goes on — and as the protocol dictates. As a result, circulating units acquire more value. It’s simple.

Buying a portion of a Bitcoin is like buying land: an extremely precious and scarce resource that, once yours, no one else will ever be able to own.

Now, that’s why we call it “perfect money”!

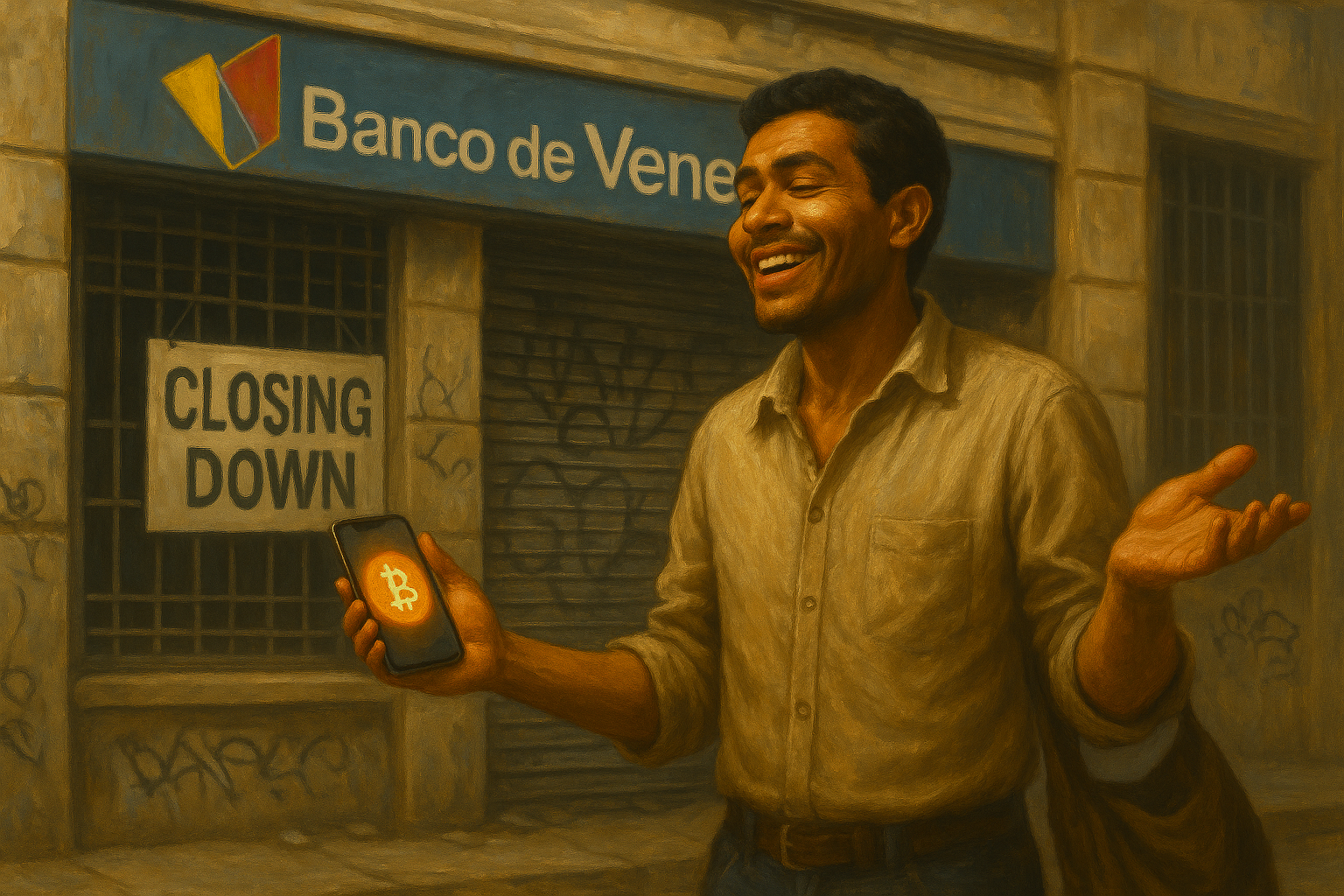

No bank? No worries!

🟠Beyond finance

Now, forget about “investing”, “making money”, or “getting rich”.

Bitcoin, and this is where it truly shines, is a tool for freedom.

Many of those who adopt it are not thinking about “ROIs” or “portfolios”.

For them, Bitcoin is a lifeline, and the only way to escape financial doom.

If you live in a hyperinflated country, you know what I am talking about. When your currency depreciates faster than light, you must find an alternative, lest you fall into absolute poverty.

Ask Venezuelans. The Bolivar is now so worthless that it’s literally being used as a fire-starter: it became cheaper than the paper it’s printed on.

Years and years of work, only to see your savings become utterly useless. Bitcoin gives those people the possibility to protect their purchasing power.

This may sound unbelievable to you, but around a quarter of the world still has no access to traditional banking.

Yes, having a bank account is considered a luxury, in many third-world countries, where remote or poor communities have to rely on other methods, such as using cash and storing their savings “under the mattress”, with all of the negatives related to it.

Theft, natural disasters, rising inflation, to name a few.

There are also several war-torn or heavily sanctioned nations where citizens are denied access to their freedom and their money.

Bitcoin can help solve this, thanks to its incredible qualities. Remember: you only need an internet connection. It cannot be banned or restricted. Governments can’t just “stop it”, because Bitcoin belongs not to a single entity, but, as we just explained, is secured by thousands of nodes.

Sounds too good to be true? Where’s the catch?

No hidden tricks, my friend. Bitcoin is exactly fiat’s true nemesis, its complete opposite.

Trying to explain Bitcoin in such a short amount of time is basically impossible. If you are now feeling confused, that’s all good; don’t sweat it. Read the paragraph once more, if needed.

Today, Bitcoin is a very well established asset, and its future is incredibly bright. It “made it”, you may say.

But it was never smooth sailing. Bitcoin’s journey, still in the making, was filled with doubt, mockery, rejection, and near failure.

The highs are very high, and the lows are ridiculously low. Being a Bitcoiner is not easy: the path is steep, and only the most committed and educated holders can make it through, although not unscathed.

Are you curious about Bitcoin’s beginnings and its evolution? Let’s go. Another chapter, another time travel.

🟠Shrouded in mystery

Bitcoin made its official debut on Jan 3, 2009, after presumably having been developed for a couple of years. Its fundamental values and concepts, however, are deeply rooted in human consciousness. Freedom: that’s what defines our species. And that’s what Bitcoin embodies.

“A purely peer-to-peer version of electronic cash that would allow online payments to be sent directly from one party to another without going through a financial institution”.

That was the opening line of Bitcoin's “manifesto”, the whitepaper, published on the internet on Halloween 2008, by a legendary, elusive, mysterious, and mythic figure: Satoshi Nakamoto.

Satoshi is Bitcoin’s creator: a true visionary, a genius you probably never heard of.

Nor have you seen a photo of him. No one has, in fact. That’s because Satoshi is only a pseudonym, and its identity is, to this day, still unknown.

That’s right. Like a ghost, operating from the shadows, Satoshi managed to remain completely anonymous and, fun fact, he (they? she?) is potentially the richest individual in human history.

Let that sink in. Not an emperor, a pharaoh, or a king; but a “faceless” cypherpunk!

And yet, not a single penny, or SAT, of his incredible wealth has ever been spent.

All of the Bitcoin he accumulated is possibly gone forever, although this is only speculation.

A true hero, a selfless mastermind who gifted humanity with one of the greatest inventions ever conceived, never taking credit for it, never profiting off it.

That’s incredibly fascinating, isn’t it?

We can still read many of his posts and comments on online forums, dating back to 2008, until he disappeared from the internet in 2011, leaving no trace of himself. He vanished into thin air, fuelling speculations and conspiracy theories about his identity and its reasons.

Satoshi created Bitcoin, he launched it, he assisted early developers in running the software and maintaining the network in the early days.

He “mined” 1 million Bitcoin, which have never been spent or moved, and then he left.

He might have died, or he might have been killed. No one knows. He most likely wanted to protect his anonymity at all costs, and the longer he stuck around, the easier it would be to identify him. That’s the most plausible reason for his departure.

What an absolute legend, however. Thank you, Satoshi!

Fiat’s failure, Bitcoin’s birth.

🟠From fiat’s ashes it emerged

Bitcoin came to life, not by accident, at the peak of the tragic 2008 crisis: the worst economic collapse in recent history, second only to the “great depression” of 1929.

Banks and financial institutions crumbled after years of speculation, dangerous and unethical manoeuvres, reckless lending, together with a massive housing market bubble that was ready to burst.

The whole system collapsed, leaving behind a trail of destruction and misery.

Notably, banks around the world were bailed out by local governments using taxpayers’ money.

A true catastrophe: millions went bankrupt, losing their life savings, homes, and businesses; inflation ran rampant and hatred towards institutions, both political and financial, grew stronger than ever: it really was fiat’s rock bottom.

This was the perfect catalyst for Bitcoin to emerge and position itself as the ideal alternative to the old, unfair, and authoritarian monetary system, although it would take several years before it could make a serious impact on the world.

Bitcoin still has PTSD from its childhood trauma.

🟠Bitcoin’s infancy

Bitcoin was thus born, from the rubble of the ‘08 crisis. But not many people at all knew about it. Only a few nerds and visionaries were able to see its enormous potential. Even then, however, no one could imagine nor predict the profound role it would later play in the world’s economy.

Bitcoin wasn’t initially a product you could purchase, as it is today. No marketplace, no exchanges. That’s because it had zero perceived value, and no market price was attached to it. The only way you could get some was by “mining” it.

At first, the network was essentially run by Satoshi and Hal Finney, a key figure in Bitcoin's early development.

The first ever Bitcoin transaction, which you can still see on the blockchain today, was in fact 10 BTC sent from Satoshi’s address to Hal’s address. A sort of test run to make sure the system was up and running. The date is 12 January, 2009.

Word quickly spread about this innovative and unique currency called Bitcoin, which gathered attention from cypherpunk circles.

March 17, 2010 marked a historic day: BitcoinMarket.com, the very first exchange, went live.

For the first time since launch, it was now possible to acquire Bitcoin by paying with fiat money.

One coin for the price of $0.003. That’s just mind-blowing, and the next fact is even crazier.

A few weeks later, another milestone: Bitcoin pizza day, a recurrence we still “celebrate” each year in the community.

That’s when Laszlo Hanyecz, a prominent Bitcoiner, initiated the first real-life transaction by exchanging 10.000 BTC for two large Papa John’s pepperoni pizzas. 30 Bucks back then; over a billion today.

The early 2010s saw Bitcoin gaining traction through massive ups and downs, Satoshi’s disappearance, and the protocol being constantly improved and adjusted by the “developers”: people who worked behind the scenes and often for free, driven only by their sheer dedication and passion for the product.

Bitcoin had a terrible reputation back then. Often disregarded, misunderstood, rejected and dismissed as pure gambling, or as the criminals’ currency.

But a small group of very smart people could actually understand its real value. We call those pioneers “the early adopters”.

The mid 2010s were for Bitcoin a period of incredible growth but also scandal, chaos and turmoil.

The very first “bull run” sent Bitcoin from $13 to $1000, resulting in widespread mainstream media coverage: BTC is suddenly on everyone’s lips!

Momentum is strong and China, a notoriously censorship-prone country, embraces Bitcoin, and it allows exchanges to operate in its market. That was an extremely significant event which, sadly, wouldn’t last long.

Disaster struck when Mt Gox, the biggest Bitcoin marketplace at the time, collapsed after being hacked. BTC’s value crashed dramatically. People lost faith.

More trouble in paradise: a civil war ensues within the community over changes to the “sacred” protocol, leading to the creation of a new “cryptocurrency” called Bitcoin Cash.

As always, and this is a recurring theme, Bitcoin rose up again, in spectacular fashion, only to tumble and collapse shortly after. An incredible bull run where it multiplied twentyfold ends up with a brutal 85% crash. Devastating.

The decade, however, ends positively, with the “mass adoption” phase in its early days. The world slowly wakes up to this unprecedented phenomenon: money that actually works.

Like a rocket being launched into space, Bitcoin moves incredibly fast. A true sensation, it created shockwaves around the world, for good or for ill.

By the end of the 2010s, it had weathered many storms and had survived several near-death experiences, but it proved to be incredibly resilient; forged by fire.

According to mainstream media, Bitcoin died hundreds of times.

🟠Adulthood

The 2020s: Bitcoin’s coming of age.

Not necessarily in terms of value appreciation, though.

The greatest bull runs do in fact belong to the previous decade.

What’s different, then? Well, It’s about reputation and solidity.

No longer is Bitcoin considered fringe, underground, or for nerds; it is now a respected, well regarded asset.

The groundwork, which culminated in January 2024 with the introduction of the ETFs, was laid years prior. “Traditional finance” institutions, big corporations, and even the White House: they all own Bitcoin! What a wild ride.

But of course, it’s not all rainbows and unicorns. Let’s see what happened in these five years, starting with “the bad news”.

“Way down we go”

2020 opened, as you remember, with the Covid pandemic. I’m sorry to remind you of those nasty days. Bitcoin didn’t like that either, rest assured. In a single day, it lost 55% of its value. A serious blow, hard to stomach.

Two more “life-threatening” crashes occurred, since then.

One happened in mid-2021, when China officially banned Bitcoin mining.

A cascading effect ensued, with more than half of the global mining network, called “the hashrate”, being instantly “deleted”.

The consequences extended much further than “just a price drop”, as you may imagine. In a few days, Bitcoin tanked, losing more than 50%.

A smaller, but still significant collapse of ~35% was seen in the market in Nov.2022, when one of the biggest scams in the history of “crypto” was unveiled.

FTX, the third largest exchange at the time, collapsed overnight — a throwback to the Lehman Brothers debacle, after being investigated for fraud. They were essentially trying to pull off a Ponzi scheme and rob their clients. Long story short, everyone who held Bitcoin on FTX lost it. Market sentiment was at an all-time low, and Bitcoin was unfairly being thrown under the bus.

More recently, the infamous “Core Vs Knots debate” sparked another massive conflict within the community.

Some say the protocol’s safety is at risk — the story is still unfolding, and no one knows how it will end. Similarly to 2017’s block size wars, this could very well end up with a structural change to the system. We’ll see.

By now, you know the drill. When Bitcoin dies, it always comes back to life, stronger than it was before. This time around, however, it not only resurrected: it transcended its very essence.

It’s now time for the good news, and they are good indeed, you’ll see.

“This Bitcoin kid had quite the glow-up, eh?!”

The “big time”

As Bitcoin recovered from its Covid wounds, it hit an all-time high of 68K.

Simultaneously, history was made when El Salvador declared Bitcoin as legal tender within the country.

That’s huge, and although the experiment wasn’t that successful, its importance cannot be overstated. This set a unique precedent which may soon become reality once again, somewhere else in the world. The message is clear: even nations are taking Bitcoin seriously.

And the same goes for financial institutions, companies, and corporations.

For years, they shunned Bitcoin, but as the saying goes, “if you can’t beat them, join them”.

More than 150 of them now hold Bitcoin as a store of value, or as the “underlying asset” for designing financial products around it.

“Strategy”, formerly MicroStrategy, being the most famous: a tech firm captained by none other than Michael Saylor, the world’s most famous Bitcoiner, who managed to accumulate around 600,000 BTC.

That makes them, obviously, the biggest Bitcoin holders in the world; and by far.

Their incredible success kickstarted the “institutional adoption” trend, which exploded in January 2024, when BlackRock, a company that needs no introduction, launched the Bitcoin ETFs: an event that redefined modern finance.

With these products now available, anyone is able to invest, or be exposed to Bitcoin’s price action, without having to own it directly. Which is scary, for the average person.

Any real Bitcoiner knows that the ETFs are a joke, and that “self-custody” is the only way. But for many, especially those who only see Bitcoin as mere investment, they can be a useful tool.

This opened the floodgates for “traditional finance” to pour their billions into the Bitcoin market; and it worked: BlackRock’s IBIT quickly became one of the best performing ETFs ever, reaching up to 2.5 billion dollars of inflows in a single week.

But the best is yet to come.

We have seen how haters turned to adopters, now let’s take it to the next level.

Since time immemorial, politicians and governments have despised Bitcoin: a form of money that cannot be controlled or corrupted, unlike their beloved fiat.

25 July 2024, Nashville, “Bitcoin 2024” conference — a man makes his appearance on stage. He vows to establish a federal Bitcoin "stockpile", if elected as the next US president. His name is Donald Trump, and both scenarios materialized, eventually.

A few weeks later, Bitcoin’s value crossed the historical and symbolic threshold of $100,000 for the first time.

March 7, 2025: arguably Bitcoin’s biggest day ever, depending on who you ask.

The White House officially implements a federal “Bitcoin strategic reserve”, clearly defining Bitcoin as “digital gold”.

16 years after its birth, the “magic internet money” made it to the big stage, being endorsed by the US government that, as per Senator Lummis, has plans to obtain up to one million coins.

You can think whatever you want about Donald Trump and his allegiance to Bitcoin; it could be fake, staged, or there could be some major conflict of interest at play.

Regardless, the fact remains: the world’s greatest economy has now embraced it.

To infinity and beyond

This is where we stand today. Not bad, right?

Zoom out for a moment, and just admire Bitcoin’s glorious ascent: from humble beginnings, once defined as “rat poison squared” by the legend Warren Buffett, to becoming THE best performing asset in the history of finance.

“Bitcoin is inevitable” they say, and for good reason. It will gradually spread and grow to the point where it potentially becomes the #1 currency in the world.

“Gradually, then suddenly”, they also say.

Several countries have already expressed their interest in following in the US’s footsteps: Sweden, Brazil, Pakistan, Taiwan, Russia; only to name a few.

Bhutan has been mining Bitcoin for years. Kazakhstan and France are planning on doing the same, on a state level.

Americans can now put Bitcoin in their 401k retirement plan.

JP Morgan is implementing Bitcoin-backed loans, lending services, and trading platforms for its clients.

Just remember: Bitcoin made it this far, and yet only very few people actually know what it is!

What do you think will happen when 10, 15, 20% of the world population adopts it?

And what do you think will happen when governments start hoarding it, accumulating it, as they previously did with gold? When international trade will be settled in Bitcoin, how much will a single unit be worth?

I’ll let you come up with your own answer.

⚫And we are done! Your first Bitcoin lesson is over.

You just read a monster chapter, the longest in this course.

I am sure I piqued your interest: are you now keen to hear more?

Good news: you only need to press a button, and jump to the next chapter, where we will get into the meat & potatoes of the ecosystem: the nodes and the blockchain!

See you soon.