6- The nodes & the blockchain

Welcome to our first “Bitcoin-proper” chapter. I hope you are enjoying the guide so far.

We have just discussed what makes Bitcoin great, especially when comparing it to fiat. You heard of expressions such as “fixed supply”, “decentralized”, and “permissionless”.

Now, it’s time to find out how this currency actually works. Are you in?

We’ll start with the absolute basics: the blockchain and the nodes. Let’s do it.

🟠The Blockchain: where the magic happens

Unless you live under a rock, you have certainly come across this strange word before. Many times, in fact. It gets thrown around quite a lot.

“Blockchain”.

What the hell does it even mean, and what is it?

Please focus, because this is a fundamental topic: everything, in the Bitcoin ecosystem, is either built on it or around it.

As you know, the blockchain is where every Bitcoin transaction is permanently recorded. It is publicly accessible, and also downloadable.

The name gives it away. The two keywords are, surprise surprise, “block” and “chain”.

A chain of blocks: that’s another way to see it.

“Chain”, because each block is connected to the previous and to the one after. The term also implies that blocks are tied to each other in a chronological order. That makes everything tidy and organized.

Ok. What’s a block, then?

That’s very simple. A block is a set — or a group — of Bitcoin transactions.

Just to clarify the obvious: a Bitcoin transaction occurs anytime Bitcoin is sent from one address to another.

You thought Bitcoin was incredibly complex, but honestly, it all comes down to this!

Well, to be fair, the “behind the scenes” are quite complex; but on the surface, it’s not hard to grasp.

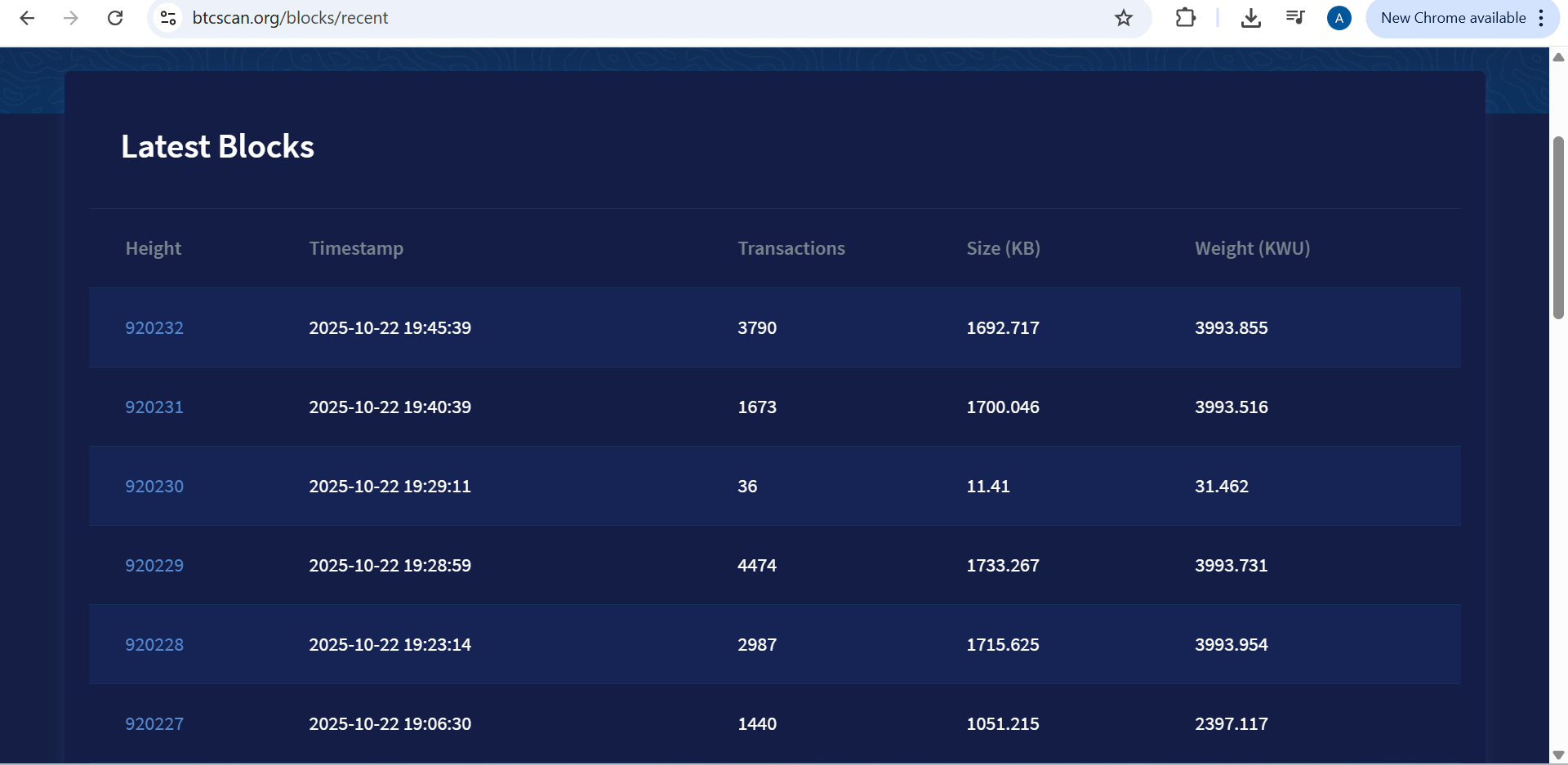

An actual screenshot from a Blockchain explorer. On the left, you can see the block #, along with its size, the time it was “mined”, and how many transactions it holds.

In the old days, banks and merchants used to keep a big ledger book, in which they would manually write every monetary transaction that took place daily.

They would report the customer’s name, and they would update their balance. Before digital tech, that’s how commerce was structured.

However, and this is crucial, who could truly guarantee the book’s genuineness?

Did those transactions actually happen? And those balances, were they accurate, or were they made up? Did the bank omit to report some shady dealings they had with a local governor, in order to avoid getting accused of corruption?

Well, no one could. It was a trust-based system.

You, as the customer, must have faith in the bank’s ability to keep the book as earnestly as possible. But what if the bank cheated? What if their boss was a dishonest chap, only interested in making profits at your own expense? If that sounds awfully familiar, that’s because it is. You guessed it: fiat is also a trust-based system.

And how does Bitcoin flip the script? Because it’s publicly verifiable. You don’t have to trust anyone here: it’s maths and code, not corrupted people. The system, thanks to thousands of independent and separate “enforcing entities” — the nodes — continuously checks its own authenticity.

As you check the book– the blockchain– you can see transactions, in chronological order, from Satoshi’s famous 10 Bitcoins to Hal in January 2009, up until today’s latest movements.

The result? When a transaction ends up on the blockchain, you are guaranteed it’s legit, and that the protocol’s rules have been followed.

Moreover, please note that every transaction that appears on the ledger is final, irreversible, and cannot be deleted — that’s why we define the blockchain as immutable.

Let’s go back to those “blocks”.

Each one of them is a small file of up to 4 Megabytes of data, and they contain, roughly, around 2,000 transactions.

Bitcoin, the protocol, “wants” a new block to be added to the blockchain every 10 minutes.

It’s not a rule that’s set in stone, however; it’s only a long term average.

Since January 3rd 2009, when the “genesis block” was mined by Satoshi, the process has never stopped, and roughly 144 blocks are being mined — added — daily.

Given those numbers, we know that, presently (late 2025), the blockchain counts approximately 900,000 blocks, corresponding to 600 Gigabytes of data.

As previously stated, anyone can explore the blockchain. Nearly one million blocks, and you are free to individually check each one of them. You can see every transaction that lies within them, as well as when they took place and, of course, which addresses were involved.

You don’t have to download the whole thing, those 600GB.

But if you do, and if you run the Bitcoin software, that’s when you become a node: one of the many safekeepers and custodians within the network.

🟠 Guardians

We defined Bitcoin as “decentralized”: it doesn’t belong to anyone, it doesn’t require the involvement of third parties or external institutions and, of course, there is no central authority running the show.

That’s intriguing, but how does it work, in practice? How can a whole monetary system sustain itself? How did it manage to thrive, without having a manager, a CEO, or any employees?

Bitcoin is a set of rules, written in code. Ok. But who enforces these rules, and why is Bitcoin defined as "incorruptible”?

This is where nodes come in!

A node is a computer. Any computer. Yes, even yours.

Anyone can participate, and that’s what makes Bitcoin special. You don’t have to be a powerful or influential person, in order to join in.

Bitcoin is the largest computer network on the planet, with some 40,000 nodes currently online. Strength in numbers, right?

Nodes are scattered across the world, and they serve two fundamental duties: they store a copy of the Blockchain, they run the Bitcoin software, and they uphold the protocol rules: they are in fact responsible for validating each transaction, before these are “allowed” to appear on the blockchain.

Imagine if the bank gave away a copy of their big ledger book to anyone who volunteered, instead of them being the only keepers.

No longer would their “secrets” be hidden away inside a safe, being jealously kept by the manager — now, many thousands of citizens could have access to the bank’s transaction history and of their “rulebook”.

Nodes are essentially the same thing.

Those who download the Bitcoin software and a copy of the blockchain automatically become their guardians.

Without them, Bitcoin would crash, because no one would be there to authenticate transactions, and cheaters would proliferate.

However, Bitcoin would truly collapse only in the nearly-impossible scenario where every node on earth is physically destroyed, leaving no copy of the blockchain or the software in existence.

Importantly, each node is as important as the one next door.

No one in Bitcoin holds more power than others: every node is the equal: they all enforce the same rules and validate — or reject — transactions.

Michael Saylor’s node, even though his company holds over 600,000 Bitcoin, has no more authority within the ecosystem than the node of a random person who owns 0.00000001 Bitcoin.

The widely distributed nature of Bitcoin vs the narrow, vertical, and authoritarian vertical power structure of the fiat system.

🟠Validators

Alright. Nodes guard the software, but how do they implement its rules?

Their other job, as we just mentioned, is to validate transactions. This is paramount, and this very process is what ensures Bitcoin stays corruption-free.

When I send Bitcoin to your address, many things happen that we can’t see.

Mainly, my transaction must be verified.

Is the Bitcoin I am sending to you “legit”? Has it been “double-spent”? Am I the rightful owner of those SATs? Has this transaction been digitally signed?

This is what nodes do.

Once I press the “send” button, the transaction is immediately broadcast to the Bitcoin network, where a node receives it for an inspection of sorts.

It goes through a strict check-list, and it is scrutinized against the rigid, tight protocol guidelines.

Once it “passes”, it is then cross-examined by thousands of other nodes, just to double (a thousand times over) check its legitimacy.

When that’s done, my validated Bitcoin transaction is ready to be included in a block, and eventually added on the blockchain, where it will live forever. That job, however, belongs to someone else — we’ll get there soon.

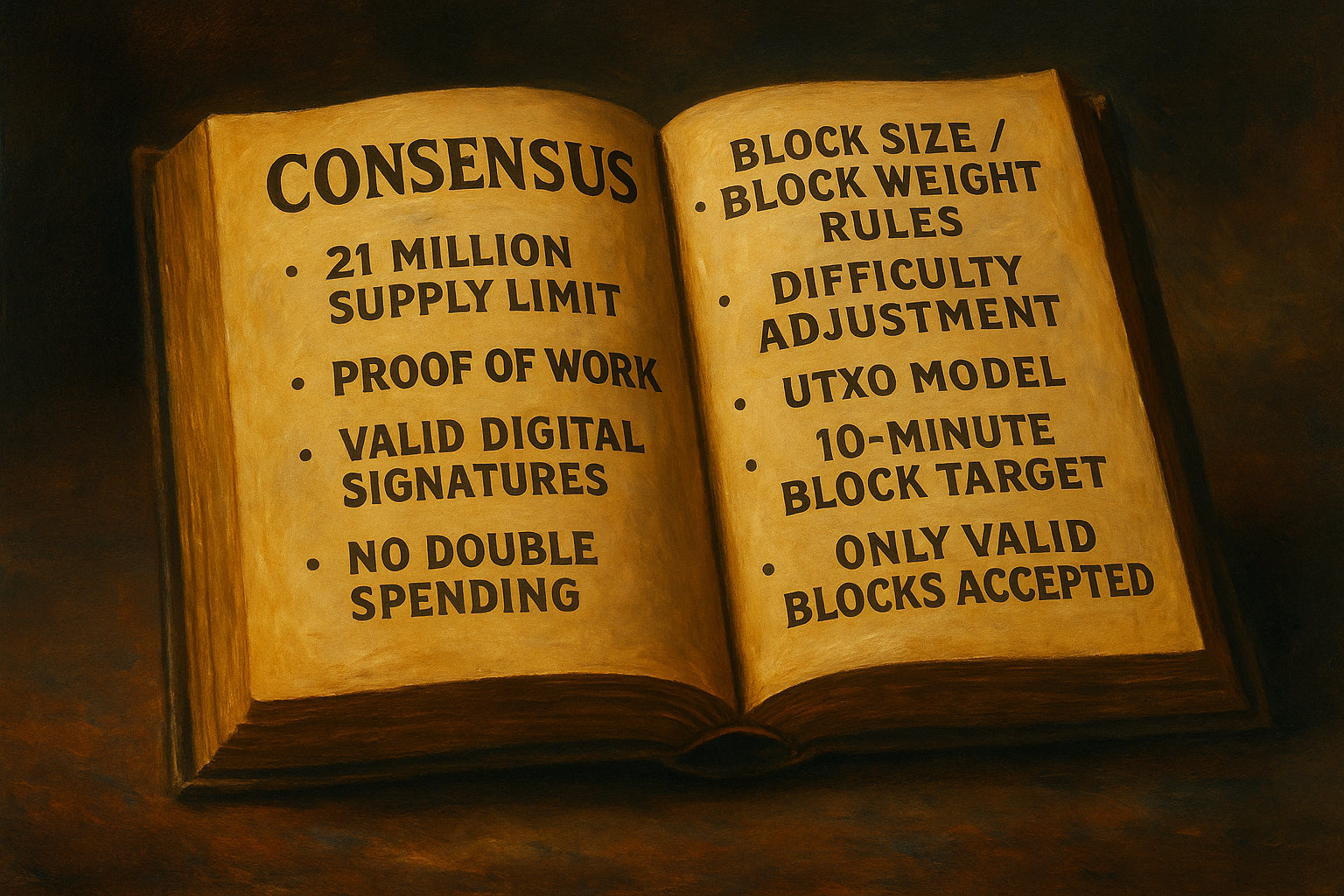

Consensus is like a rulebook: it ensures Bitcoin’s core principles are preserved through time.

🟠Attacking Bitcoin?

Nodes play another chief role, together with miners and, more broadly, the open market.

They do, in fact, hold an important position in a mechanism called “consensus”.

Let’s simplify it to the max, so that we can introduce this fundamental, core principle.

We know that Bitcoin is an open source software. And it makes sense, given what we just talked about. It’s not proprietary, and it is not owned by anyone in particular.

Does that mean the protocol is unchangeable and “stuck” to 2009, when Satoshi released it?

Not quite.

Open source means that anyone, given they have the right coding skills, can modify the software as they please.

Wait a second. Am I saying Bitcoin’s rules can be changed, tweaked, improved or destroyed? If you are somewhat baffled, that’s understandable. Doesn’t that open up scenarios of manipulation, co-optation, or hijacking?

Fear not, fellow Bitcoiner, because that’s where consensus comes to the rescue.

In Bitcoin, nodes are free to decide which “version” of the software to use.

Nodes are self-sovereign entities: each one of them is independent and does not obey anyone except for themselves. Anarchy, remember?

You know how, in some videogames, you are able to not update to the newest patch, and keep playing the “old” version?

Well, it’s somewhat similar in Bitcoin.

I, Alessandro, am 100% free to tweak Bitcoin to my liking, and I can do it right now. Let’s pretend I could, ignoring the fact that my coding skills are below zero.

Let’s say that I wish for Bitcoin to not have a limited maximum supply of 21 million, as it was envisioned by Satoshi.

As absurd as it seems, I can go ahead and do it. I can reprogram a new version of the software, and release it.

Now — does that mean my new Bitcoin automatically becomes the new standard?

Nope. That’s because I just broke consensus: the process where thousands of nodes independently enforce and preserve Bitcoin’s core rules. One of those principles is indeed the 21 million fixed supply, for example.

So what would happen, once my new version of Bitcoin is available for download?

Anyone would be free to install it and run it. Let’s say it’s extremely successful, and 70% of the nodes in the network upgrade to “DojoBTC”.

Is that the new standard Bitcoin around the world?

Again: no, it’s not.

DojoBTC would become a separate currency, with its own blockchain and its own rules.

Here, Bitcoin’s protocol was broken, and one of its fundamental features violated. Thanks to consensus, this cannot become Bitcoin.

This is why Bitcoin can’t be hijacked. Do you want to manipulate it, corrupt it? Go ahead, try your best. Create the worst version of it, and launch it. If anyone follows you in your endeavour, that doesn’t really mean much.

Consensus exists to prevent such shenanigans.

That’s exactly what happened in 2017, when Bitcoin Cash was created.

A group of people wanted to bring changes and improvements to the software by increasing the size of each block. Some nodes followed, while most didn’t.

Consensus was preserved and it remained unchanged.

The “old” Bitcoin still reigned. However, a new version was created. It has similar rules, except for the blocks’ size.

Bitcoin Cash is still around, but please note it is a separate currency: it is not Bitcoin.

That’s what we call a hard-fork: when a group deviates from the consensus rules, and a separate Bitcoin is created, along with a new blockchain.

In the end, please understand just how crucial the nodes are.

This may sound a little toxic, but within the community, many say “you are not a Bitcoiner until you run a node”. They are not wrong.

Bitcoin’s rules are only kept alive because of those people who volunteered and run a node; keep that in mind.

And that’s all, for now.

You just got acquainted with the blockchain and with the nodes, and there is one more element of the Bitcoin holy trinity we need to go through, before your foundational knowledge is laid: the miners!

Get ready for an exciting chapter, coming right up.

If nodes are in charge of validating transactions, who is responsible for gathering them and forming blocks? How is Bitcoin “created”? Stay tuned!