4- money

We just uncovered some uncomfortable truths about the fiat financial system.

We learned that money is controlled and manipulated by powerful institutions, entities that are mostly concerned about making profits.

We saw how fiat currencies are on their merry way to their by-design deaths.

If you remember, I left you with a question, at the end of the last chapter. “What is money?”

A seemingly simple riddle, yet unanswered to this day. This very question has puzzled the most brilliant minds for centuries, often sparking hot debates and never-ending arguments.

There are several schools of thought regarding this topic, and today we’ll try, though only by scratching the surface, to explore this fascinating, controversial, and fundamental question.

We’ll also take a short history lesson, together with a side-by-side comparison: fiat vs Bitcoin. Which is the best form of money?

Well, I suspect you know the answer already.

Defining money

“Money is any item, product or substance that carries some amount of perceived value. It serves three main functions: it acts as a form of payment in the exchange of goods and services. It is a store of value, retaining its purchasing power over time; and it functions as a unit of account, providing a standard for measuring prices”.

That was my own definition, which isn’t too far from what you’ll find in a typical finance book, I guess. At its core, that’s what money does.

Aside from these three crucial properties, there are other qualities an item must have in order to be considered a “good form of money”.

These are:

-Portability: easy to carry, transfer, and move around.

-Durability: it lasts throughout the years without breaking, spoiling, or rotting.

-Divisibility: it can be divided into smaller units, without having its total value compromised.

-Scarcity: it cannot be created endlessly, and its total supply is not infinite.

-Acceptability: it must be widely recognized, trusted, and verifiable.

-Fungibility: any unit is the same as others of the same kind: they are interchangeable and they are not unique.

These will come in handy, you’ll see.

Let’s go back, for a moment, to the definition of money and, in particular, to the concept of “perceived value”.

This is crucial in order to understand Bitcoin and, more broadly, money.

The term “perceived” implies that value is not absolute.

It is, in fact, and contrary to what the fiat system wants you to believe, relative and contextual to a certain environment, population, or society.

If you were to give me a gold ingot now, I would say it is incredibly valuable. Life changing, even. In the world I live in, I could sell it today for an enormous profit that would set me up for decades.

Now— try giving the same gold ingot to a man who lives in a remote and primal tribe, say, around the arctic circle; isolated and with no contacts with the outside world.

Would that be as valuable to him? Sure, he could make something out of it. But he most likely wouldn’t treasure it as much as I would. In the world he lives in, gold is nothing special: it’s just a pretty metal.

Can you see how value is not inherent to a certain item? People decide whether or not something carries it, depending on what it can do for them.

With all this in mind, let’s rewind time to the days where central banks did not exist, and let’s take a short trip through the history of money.

Rice, salt, seashells, and gold coins: they were all legit currencies.

From proto-money to gold dominance

Long before your state-issued paper notes, people came up with several different forms of money.

Many historians agree: the passage from the barter system to real trade was one of humanity’s greatest leaps forward.

In philosophical and abstract terms, I will even go as far as to say that money had a similar impact to language and numbers.

It wasn’t a mere “You sell, I buy”; but a whole new paradigm: a new way to see and interpret the world, and to interact with others.

Societies and civilizations around the world flourished thanks to the implementation of new commerce routes, along with more standardized and widely recognized new currencies.

No more did our ancestors have to rely on the “double coincidence of wants”, the driving force behind bartering. The introduction of money meant, among a myriad of other improvements, a new-found independence. Communities that weren’t able to produce vital crops such as wheat, for example, now had the ability to just buy it.

And that’s huge!

Of course, that didn’t happen overnight. The process was lengthy and, importantly, not uniform across the planet. In fact, as crazy as it may seem, barter still exists to this day, in certain remote and isolated societies.

The first credible evidence of items being used as a medium of exchange dates back to 3000BC. The country? Mesopotamia.

Does the name ring a bell? Come on, I’m sure it does. The code of Hammurabi, the Sumerians and the river Tigris? There you go, a nice little throwback to your school days.

Those guys were, 5000 years ago, already using silver as a unit of account. Debt and taxes were in fact denominated in it, while barley was used as an everyday currency.

More findings suggest that seashells (yes, for real) used to be a widely accepted form of money among African societies, around the year 2000BC.

Cacao beans became the standard medium of exchange in the Aztec empire.

Cattle was, for many centuries, and in several regions (India, Africa, Eurasia), an item so valuable that it was regarded as the best store of value and unit of account available. Ask ancient Romans and Greeks, if you don’t believe me.

In feudal Japan, Samurai were paid in rice bushels.

The word “salary” comes from the Latin expression “money for salt”. Legionnaires were rewarded with literal “salt vouchers”— the mineral was perceived as incredibly valuable, and it’s not surprising that, in some remote corners of the empire, it actually replaced coins as currency.

Gold: the first truly global currency uniting—via commerce— civilizations across time and space.

The golden years

Things started to change when, around 600 BC, the kingdom of Lydia (modern-day Turkey) began minting coins made of precious metals.

This set the standard for a new system that would last for more than two millennia.

Coins issued by the respective kingdoms were a much more advanced and perfected form of money: they built trust, reliability, simplicity, and practicality, which resulted in a greatly improved and more precise trade system.

While “commodity money” (all of those items we just listed) still co-existed, the new “precious metal coinage craze” spread like a wildfire. And for good reason.

Gold and silver became the backbone of “early finance”, and they were quickly adopted essentially everywhere. Greeks, Romans, Indians, Chinese, Mongols— you name it.

These two materials dominated the global commerce scene for a very long time. They were, in a way, replaced around the 19th century, when paper money emerged as a simpler, more versatile, and practical solution.

Gold, the undisputed king of money, was still the anchor of basically every local economy.

Currencies were, in fact, backed by gold. They couldn’t be produced at will. No big printer. They had actual value, because each unit corresponded, and was interchangeable, with physical gold coming from the government’s own reserves.

Believe it or not, there was a point in history where every citizen of the British Empire could exchange one Pound for 7 grams of actual gold.

Governments under this system had to be very careful with how much money they made. Produce too much of it, and everyone would come knocking at their door asking for gold. It was a very delicate balance.

This period, which precedes the two world wars, is sometimes referred to as “the first gold standard”. Gold ceased to be directly used to produce coins, but it was still the “reference” for the newly created paper money.

Now, let’s take a quick step back. Zoom out for a second, and look at all of those “currencies” we just discussed. Silver, cattle, seashells, and the lot.

We know, as history tells us, that those were all legit and valid forms of money, accepted and used by their respective communities.

And why is that?

Think about it. What’s the common denominator among all of them? Yes, it’s the good old perceived value.

What do they all share, to a certain extent? They all satisfy one or more prerequisites; those attributes we mentioned earlier in the chapter.

Those items were not perfect, of course. Some were a terrible store of value, while some showed amazing “portability” and “divisibility” qualities.

Note that no item fully meets the criteria.

As Sowell famously said: “there are no solutions, only trade-offs”.

Still, those objects and materials offered great value to people, and, as a consequence, they were used as money. This was done deliberately, and not by decree.

Gold and silver became so dominant for a simple reason: they went above and beyond, and they got very close to reaching the “perfect money” status. They satisfy all of the qualities required, and then some.

The world figured this out very early on, and gold was rightfully hailed as the most precious substance on earth; and a great power was bestowed upon it: to become humanity’s chosen form of money for more than 2000 years!

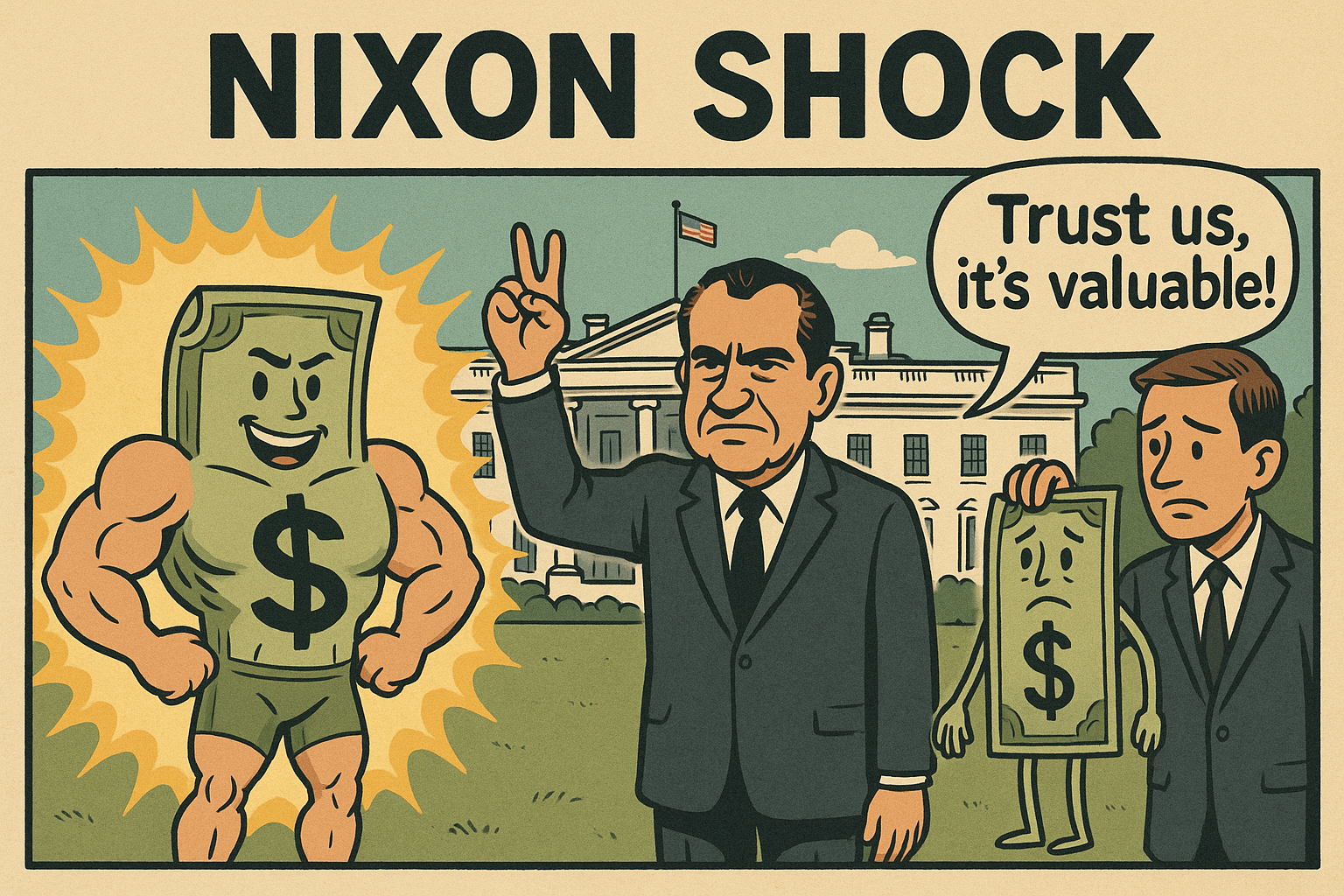

A gold-backed Dollar vs a nothing-backed Dollar. Cheers, Nixon

Fiat arises

Money, as we know it today, is surprisingly young.

The modern fiat system, where central banks have the ability to print currencies at will, generating high inflation rates, only came into being after 1971.

”The Nixon shock”: a notorious, yet often ignored event where the concept of money was forever marred.

Before 1971, most of the world was under the Bretton Woods financial system.

This was essentially a commercial/political deal where the US helped countries ravaged by war to rebuild their economies.

The States, the most prominent and richest country in the world, would guarantee especially favourable trade deals to those nations who, in exchange, had to tie their currencies to the dollar.

Every major international trade would have to be settled in US dollars.

Needless to say, this created an unbeatable dollar-dominance, and an even stronger financial strength for the Americans, who cemented themselves as the undisputed global superpower.

Crucially, the dollar was backed by gold.

However, contrary to what we just saw with the old British empire, only governments or banks under the Bretton Woods could actually exchange paper currency for physical gold.

The redeemed gold came straight out of the US’ own vaults. Citizens were not allowed to do that anymore.

The fixed rate was one ounce of yellow, shiny metal for $35.

This was obviously aimed at strengthening the dollar even further, especially in the eyes of foreign traders and institutions. It was good as gold, literally, and it became so dominant that it reached the fabled status of “world’s reserve currency”. Not bad.

However, as it’s often the case, the government bit off more than they could chew, and the house came crashing down.

The US saw their gold reserves drying up, after years of careless and aggressive printing.

Remember: more paper currency around means more gold that people were entitled to exchange.

Those were the gold standard’s final days, as President Nixon put an end to it, in 1971.

The dollar was no longer going to be backed by gold, and the fiat system was thus “created”, as many countries followed in the US’ footsteps.

This was a pivotal moment that reshaped the very concept of money, for the first time in more than 5000 years.

Currencies, starting with the US dollar, stopped being backed by actual value.

And that’s the most defining aspect of fiat money: it is backed by nothing except for the empty promise of a central bank or a government.

When Bitcoiners say fiat is utterly worthless, this is exactly what we mean. Please, take a moment to reflect on it.

Self-explanatory.

Bitcoin vs fiat

Our little journey through time ends here— the date is January 3rd 2009, and Bitcoin officially just launched.

It took us more than five millennia, but we did it. We, at last, managed to figure money out, and created the best version of it.

Let’s now compare Bitcoin against fiat money, by using those attributes I mentioned in this chapter’s intro. There is one clear winner, you’ll see.

-Perceived value. Fiat: next to none. I don’t need to explain this any further, I hope. BTC: currently sold for $125,000 per unit

-Form of payment. Fiat: usually only accepted within its country of origin.

BTC: a global, borderless, and at-the-speed-of-light payment system that only requires an internet connection to be used.

-Unit of account. Fiat: the only point where it’s superior to Bitcoin, for the moment. Prices are, all over the planet, still denominated in fiat. BTC: it’s a new currency, and, as a result, prices are not yet denominated in Bitcoin. However, the day is not too far off— mark my words.

-Store of value. Fiat: disastrous performance here. For the exact numbers, please refer to chapter N2. Just as a reminder, though, the major fiat currencies have lost up to 30% of their value since 2020.

BTC: the best store of value currently available to humans. A currency that saw its value increase over 1.5 million percent since 2009. Oh yes.

-Portability. Fiat: mediocre. You cannot carry large amounts of cash on your person without facing legal problems. Digital units can be sent or moved across the world, although not without hassles and inconveniences. BTC: you could carry the equivalent of 100 billion dollars without anyone noticing. You could send the same amount to the other side of the world with a single click, and in about 5 minutes.

-Durability. Fiat: cash is not too durable, as it is subject to erosion. BTC: it will last forever, as it is a digital-only product.

-Divisibility. Fiat: one unit can be divided into several, typically 100, smaller ones. BTC: one Bitcoin can be split into 100 million tiny parts, called “Satoshis”, or "SATs”.

-Scarcity. Fiat: its weakest point, from which a plethora of issues is generated. Fiat’s total supply is infinite, as it can be produced endlessly by central banks. BTC: this is, among many other areas, where Bitcoin truly shines. Only 21 million units will ever be created, making it the scarcest asset available today.

-Fungibility. Fiat: fungible in the short-term. A $10 note has the same value of a $10 note from 5 years ago. But over the long-term, this quality seems to decrease. Coins and notes are replaced, “retired”, re-designed, and some of the old ones won’t be accepted anymore. BTC: one Bitcoin from 2009 is exactly the same as one from the year 2139.

Ouch. Sorry, fiat. You have been demolished, again; it can’t be helped.

I just showed you, over two long chapters, how this type of money is deeply flawed, unsustainable, unjust, and whatnot. No need to repeat myself.

Before you started reading my guide, the concept of something digital, not-real, being used as money seemed utterly absurd to you.

And it still is!

Am I right?

If that’s the case, don’t worry. In fact, that’s perfectly understandable. The idea is not easy to grasp: remember what I told you before? It took me several months, before I could overcome the mental hurdle of Bitcoin being actually valuable and legit as a currency.

The process of rejecting your current beliefs and embracing something new, potentially life-changing is not simple at all; I warned you.

Ultimately, I am not expecting you to change your views now. No rush, we have time.

For now, I’d be happy to know that, at least, doubt has crept up your mind.

If you are now beginning to re-evaluate, second-guess, or even (in part) reject the idea of fiat money; well, that would be a huge win for me!

This is the very first step in your Bitcoin journey: waking up to the absurdity of the fiat system.

We haven’t actually answered the “what is money?” dilemma. No one has, to be fair. At least we tried.

And, most importantly, we have now set the stage: Bitcoin is ready to enter the scene and to make its appearance!

After a long introduction, we are now ready to dive in.

Join me in the next chapter, as we go through Bitcoin’s history and its most defining properties. Why is it so special, and what makes it so unique?